REPORT: Sustainable Investing Coverage in Business Media

Posted on June 4, 2013

INTRODUCTION

During the past few years, VOX has noticed an increase in the number of people and organizations calling for a longer term approach by the investment and analyst community when it comes to valuating companies. The belief that the continued focus on short term, quarterly analyst calls impedes a company?s ability to plan for and integrate into their business strategy the impact that population increases and risks associated from climate change will have on them in the near future. While some in the investment community?like the SRI?have been calling for a more long-term approach for quite some time, we believe that increasingly more traditional investors and analysts are beginning to also recognize the need as well.? To test this assumption, VOX looked at three media outlets that these types of investors and analysts go to for information on companies?Seeking Alpha, Bloomberg and Business Insider.

METHODOLOGY AND GOAL

The research technique employed was a sweep in each outlet using the terms ?ESG,? ?sustainable investing,? ?sustainable investment,? and ?social governance.? Separately, we also searched for the phrase ?climate change? in the same three outlets for the same time period. The goal of the research was twofold:

- ?Determine if there was a noticeable spike in coverage on these issues since 2011

- Analyze the stories to determine if they were supportive or dismissive of the need for a more long-term approach

?DATA

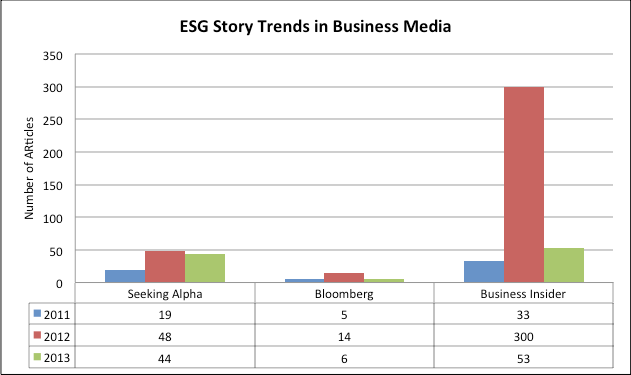

Figure 1

?

Analysis of Story Trends

As Figure 1 shows, there has been an increase in the frequency of stories on this topic since 2011.? Business Insider has seen the greatest number of stories on this topic.? While Bloomberg and Seeking Alpha did not have the frequency of stories as Business Insider, both showed increases in coverage.? It is also interesting that Seeking Alpha has nearly eclipsed the number of stories this year over the total for 2012.

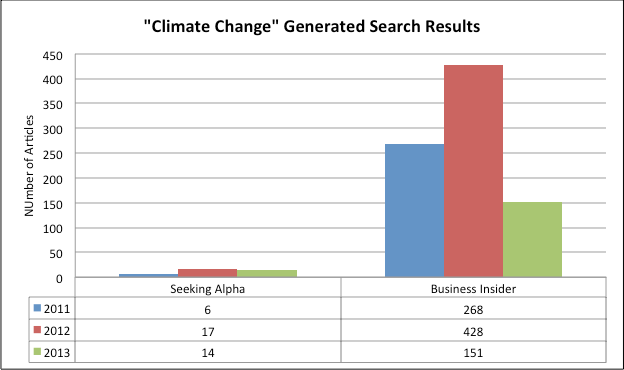

Figure 2

Bloomberg data is not included because the search produced over 3,000 results that could not be sorted through due to sensitive time considerations in the production of this report.

Frequency? of ?Climate Change? Related Stories

The ?climate change? search was separated from the other search terms because we thought there might be too many stories on this phrase and did not want to skew the results.? There were indeed a significant number of stories on this topic in both Business Insider and Bloomberg?and as the note below the Figure 2 indicates?we did not chart Bloomberg because there were over 3,000 results and no easy way to distinguish which year they appeared.? And, while Seeking Alpha had a very limited number of stories on this topic, it also showed an increase in the number of stories that have appeared since 2011.

Content Analysis?

The final analysis takes a look at the direction of the articles?were they generally supportive or dismissive of a more long-term approach.? Overall, the stories that appeared in all three outlets tended to be supportive of a more long-term approach.

Representative of the type of coverage that appeared in Bloomberg were these articles?Sustainable and Responsible Investing Goes Mainstream reported that sustainable and responsible investing (SRI) is gaining momentum, transitioning from niche to mainstream investing. Top Investors Will Feel Heat of New Epoch poses a series of questions like ?What if there is a future that demands that an investor change course or at least learn new tricks?? It prods investors to take note of the changing times, ask questions, and prepare for the worst, reading as a call to action. Meanwhile, the outlet?s climate change stories are more matter-of-fact, such as Ignoring Carbon Cost ?Bad Investment Decision,? David Blood Says, which encourages companies to recast their investment decisions in energy as long-term economic issues.

Business Insider articles were similar to Bloomberg, but we also noticed that some stories discussed the general lack of understanding of the term ?sustainable,? and the tendency to view sustainable as a static idea. It?s Too Easy For Companies And People To Slack On Sustainability examines the term and its use in discussions ranging from business to health and leisure. The tone of the outlet?s climate change stories focused on the emerging risks associated with it.? Investors Are Now Profiting From The Fear Of Climate Change is representative of this story line.

Seeking Alpha?s articles were particularly to-the-point. Do Responsible Companies Make Good Investments? This article reported on the shift in capital from companies with inadequate ESG performance to companies that consider ESG a top priority of their business. It presents investors with opportunities and advice on best practices to harness ESG analytical tools to improve their ESG scores. The outlet?s climate change coverage is more analytical in nature, setting it somewhat apart from Business Insider and Bloomberg. The report, Sense And Nonsense About Climate Change. What Do Investors Need To Know?, analyzes the risks associated with climate change and presents a convincing argument, augmented with recent graphic data, for investors to ratchet up efforts to address climate change to result in an increased pay off in higher investment returns.

CONCLUSION

The preliminary research findings support VOX?s hypothesis that between 2011 and 2013 there was both a noticeable increase in three key media outlets on the coverage of these issues and the content in them tended to be supportive of the need for a more long-term approach by investors and analysts.

Source: http://voxglobal.com/2013/06/report-sustainable-investing-coverage-in-business-media/

joe avezzano kanye west theraflu joey votto the masters live mega millions winner holy thursday chris stewart

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.